Accountants play a vital role in the financial well-being of individuals and businesses, and with that role comes a great responsibility to protect the confidentiality and privacy of their clients' financial information. In today's digital age, it's more important than ever for accountants to secure client files and documents and limit access to them in order to prevent unauthorized access, use, or disclosure of sensitive information.

The Importance of Securing Financial Information

One of the primary reasons for securing client files is to prevent financial loss. For example, if a client's sensitive financial information is accessed by an unauthorized person, they may use that information to commit fraud or identity theft. This can cause significant financial loss for the client and damage their reputation. Additionally, if a client's sensitive information is accessed or stolen by a competitor, it can give them an unfair advantage in the marketplace.

Complying with Laws and Regulations

Another important reason for securing client files is to comply with various laws and regulations. For example, the Sarbanes-Oxley Act requires publicly traded companies to implement appropriate internal controls to protect sensitive financial information. Similarly, the General Data Protection Regulation (GDPR) requires businesses to protect the personal data of European Union citizens. As accountants often handle sensitive financial and personal information, they must ensure that they are complying with these laws and regulations by implementing appropriate security measures.

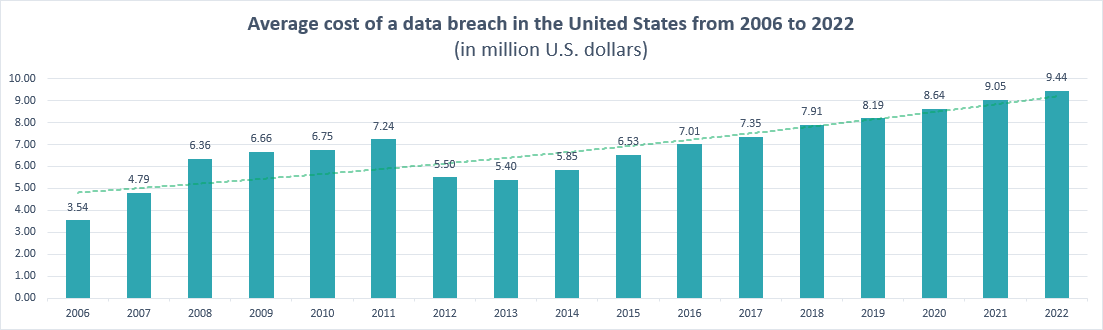

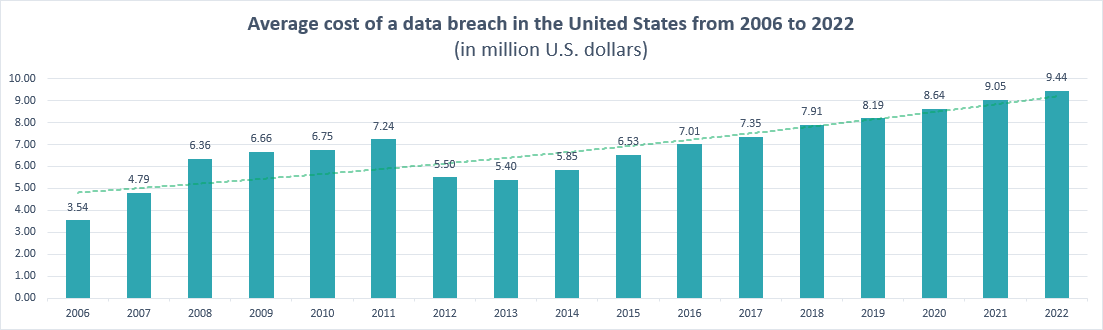

The Consequences of Data Breaches: Financial Loss and Legal Penalties

Source: statista.com

Data breaches are becoming increasingly common, and the financial and reputational impacts can be severe for both businesses and individuals. According to the 2020 Data Breach Investigations Report by Verizon, 43% of data breaches were caused by external actors, while 14% were caused by internal actors. The report also found that the most common type of data breaches were those that involved the theft of financial information.

In addition to the financial losses that can result from a data breach, businesses may also face significant legal and regulatory penalties. For example, in the United States, businesses that suffer a data breach may be subject to fines and penalties under state and federal laws, such as the Health Insurance Portability and Accountability Act (HIPAA) and the Payment Card Industry Data Security Standards (PCI DSS).

Using Encryption to Protect Data

There are several ways that accountants can secure client files and documents and limit access to them. One of the most effective ways is to use encryption to protect sensitive information. Encryption is a process that converts plain text into a coded format that is unreadable to unauthorized persons. This ensures that even if client files are accessed by an unauthorized person, they will not be able to read or use the information contained within them.

Limiting Access to Client Documents

When managing sensitive client documents, limiting access is a crucial aspect of ensuring data security. Unrestricted or poorly monitored access to files can lead to unauthorised use, data breaches, or inadvertent errors that compromise confidentiality. By implementing strict access controls, you can protect your clients' sensitive information while meeting compliance obligations such as GDPR or other regulatory requirements.

Auditing Document History for Accounting Practices

Ensuring the integrity and security of client documents is paramount in accounting practices. One of the most effective ways to achieve this is through auditing document history—a process that tracks and records every interaction with financial documents. This not only safeguards sensitive client information and prevents fraud but also ensures compliance with key regulations, including the Sarbanes-Oxley Act (SOX), General Data Protection Regulation (GDPR), International Standards on Auditing (ISA), and FINRA. Implementing robust auditing practices helps accounting firms meet legal requirements while maintaining transparency and accountability in all document transactions.

Key Client Documents to Secure

As an accountancy practice, you handle a range of sensitive client documents that must be secured to protect client confidentiality, comply with data protection laws (such as GDPR in the UK), and prevent fraud. The key client documents that should be secured include:

- Personal Identification: Passports, driving licences, National Insurance numbers.

- Financial Records: Tax returns, payroll records, bank statements.

- Legal Agreements: Engagement letters, shareholder agreements, loan documents.

- Transaction Records: Invoices, receipts, expense claims.

- Investment Information: Portfolios, pension statements.

- Correspondence: Emails discussing sensitive financial matters.

- Business Documents: Company formation papers, insurance policies, HMRC correspondence.

Implementing robust security measures for these documents is essential. For strategies on encryption, access

control, and file-sharing security, refer to the full article.

Conclusion

In conclusion, accountants have a legal and ethical responsibility to protect the confidentiality and privacy of their clients' financial information. Securing client files and documents and limiting access to them helps prevent unauthorized access, use, or disclosure of sensitive information, which can lead to financial loss or damage to the client's reputation. Additionally, accountants must also comply with various laws and regulations, such as the Sarbanes-Oxley Act and the General Data Protection Regulation (GDPR), which require them to implement appropriate security measures to protect client data.